Excel-based All-in-one income tax preparation software for Non-Government employees to pay tax

under the new personal tax regime u/s 115BAC for A.Y 2024-25

Excel calculator to compare tax under existing and new personal tax scheme u/s 115BAC. The Union Budget 2023-24 has disappointed individual taxpayers who expected tax benefits in the form of a significant hike in the basic income tax exemption threshold and an increase in deductions, especially under Section 80C of the Tax Act on income, 1961.

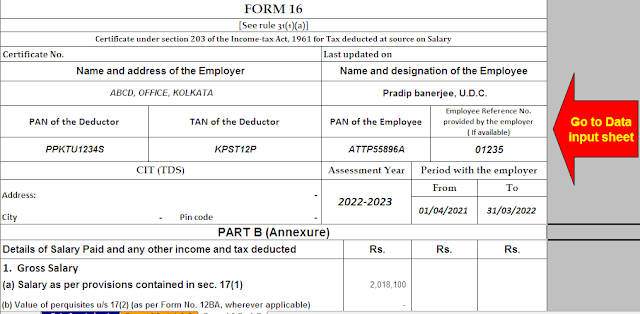

You may also like:- One by One PreparationExcel Based Form 16 Part A and B and Part B for the Financial Year 2022-23 and Assessment Year 2023-24

However, instead of fulfilling expectations, the government left the existing tax exemption limits and available deductions/rebates unchanged.

However, for AY 2024-25, the basic exemption limit for the new simplified personal income tax regime has been increased to Rs. 3 lakhs, and the number of tax brackets has been reduced to five as below:

For A.Y 2024-25, the basic exemption limit for the new tax regime has been increased to Rs. 3 lakhs and the number of tax brackets has been reduced to five as below:

Up to Rs. 3 lakhs | Nil |

Income of more than Rs. 3 lakhs up to 6 lakh | 5% |

Income of more than Rs. 6 lakhs up to 9 lakh | 10% |

Income of more than 9 lakhs upto 12 lakhs | 15% |

Income of more than 12 lakhs up to 15 lakhs | 20% |

Income above Rs. 15 Lkahs | 30% |

.

The Finance Bill 2020 (26 of 2020) has introduced new sections namely section 115BAC to implement the new scheme of taxation on the income of individuals and HUFs.

The Budget for 2023-24 proposes to introduce a new tax regime u/s 115BAC as the default regime. However, taxpayers have a choice of the former administration.

Unlike the existing tax regime, which has three taxable brackets with a minimum rate of 5% and a maximum rate of 30%, the new tax regime has five tax brackets with a minimum rate of 5%, each with a 5% increase in the top tax bracket except for the fifth disc where the increase is 10%.

A comparative overview of tax brackets and rates under both regimes is as under:

Tax Brackets | Tax rate (Existing Regime) | Tax Rate (New Regime) |

Upto Rs 2.50 Lakhs | Nil | Nil |

From > Rs. 2.50 lakhs to Rs. 3.00 lakhs | Nil | 5% |

From > Rs 3 Lakhs to Rs 5 Lakhs | 5% | 5% |

From > Rs. 5 lakhs to Rs. 6 lakhs | 5% | 20% |

From >Rs. 6 lakhs to Rs. 9 Lakhs | 10% | 20% |

From > Rs 9 lakhs to Rs 10 lakhs | 15% | 20% |

From > Rs. 10 lakh to Rs. 12 Lakhs | 15% | 30% |

From Rs 12 Lakhs to Rs 15 Lakh | 20% | 30% |

Above Rs 15 Lakhs | 30% | 30% |

.

Just looking at the table above, it seems like a perfect gift for taxpayers where tax rates have been reduced and more tax brackets have been introduced to reduce the tax burden. But this lucrative new tax regime has a proviso that many taxpayers will not like.

Under the new tax regime, the taxpayer is not entitled to many of the exemptions and deductions that the average taxpayer relies on heavily, not only to make investments but also to plan and reduce his or her taxes . . . . Notable deductions/exemptions that would not be available under the new tax regime include standard deductions on salaries, home loan interest, section 80C deductions (for insurance premiums, PF, school fees, etc.), etc.

The relief, however, is that the new regime is purely optional and it is entirely at the discretion of the judge as to whether or not to opt for it.

Taxpayers don’t know what to do. Whether it’s continuing to pay the money available for insurance premiums, provident funds, etc., or deferring their home loan, etc. Helpless individual taxpayers who do not have access to a tax professional find it difficult to determine which tax regime is beneficial to them.

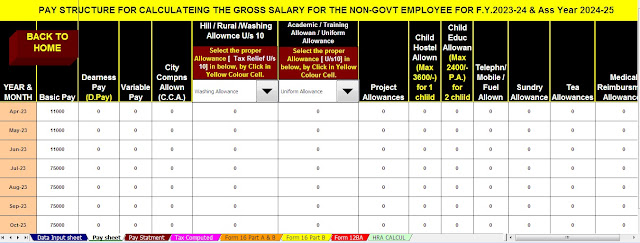

Feature of this Excel Utility:-

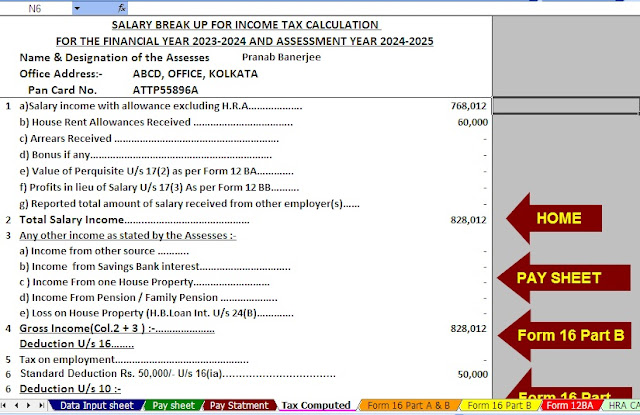

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Non-Government Employees Salary Structure.

4) Automated Income Tax Form 12 BA

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24

March 20, 2023

March 20, 2023

0 comments:

Post a Comment