Which is better- the old or the new tax regime? The Budget 2023 for the current financial year brought

a major change for the assessee by introducing the new tax regime as voluntary compliance for all

taxpayers.

Although a private individual can choose to switch to the old tax regime if he/she wishes. There are

advantages and disadvantages to both the old tax regime and the new tax regime, but it can be

confusing for taxpayers to choose the most appropriate regime for themselves. Let us examine the

various aspects to be considered in the old tax regime and the new tax regime in F.Y 2023-24.

You may also like- At a time 50 Employees Auto Calculate and automatic Preparation Income Tax Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24

Under the new tax regime

The new tax regime has increased the range of tax rates from 0% to 30% with a minimum exemption of up to Rs 3 lakhs and the maximum tax rate of 30% applicable from Rs.15 lakhs. The new income tax rates are listed below:

INCOME TAX SLAB RATES IN THE NEW TAX REGIME 2023-24

ANNUAL INCOME | NEW TAX REGIME |

0-3 Lakhs | Nil |

3-6 Lakhs | 5% |

6-9 Lakhs | 10% |

9-12 Lakhs | 15% |

12-15 Lakhs | 20% |

Above 15 Lakhs | 30% |

Highlights of the New Tax Regime 2023-24

1. The new tax regime is voluntary compliance for the year 2023-24.

2. A person earning Rs. 7 without annual entitlement to abatement.

3. Higher rate of surcharge on income above Rs. 5 crores reduced from 37% to 25%.

4. In order to simplify complicated paperwork and reduce the burden of compliance and administration on the taxpayer and tax authorities regarding tax deductions and exemptions, fewer deductions were made.

5. Some tax deductions not allowed under the new tax regime are available

A. Waiver of Travel Allowance

B. Rental Assistance

C. Educational Assistance for Children

D. Exemption for employment taxes

E. Interest on home loans

F. Deduction for specified

6. No stringent rules and regulations for your investments under the new tax regime.

You may also like- At a time 50 Employees Auto Calculate and automatic Preparation Income Tax Form 16 Part A&B for the Financial Year 2022-23 and Assessment Year 2023-24

As announced in the 2023-24 investment budget, the new tax regime has been imposed by default, but still an individual can choose between the old tax regime and the new tax regime if he/she wishes. If you want to claim deductions and exemptions, the old tax regime is more favorable, otherwise, the new tax regime has multiple levels of income brackets and rates.

The key point to understand here is which tax regime allows you to take home more money.

Let us take an example to understand the situation in both lights, Mr. Suresh earns Rs. 50,00,000 per annum. He is claiming a deduction under section 80C against LIC and EPF for Rs. 1,50,0 He has taken out health insurance for which he pays a premium of Rs 25,000 which he claims as tax deductible under section 80 D. He also claims a tax-free traveling allowance of Rs.38,000 and rent allowance of Rs. 1,60,0 Let’s calculate the tax due in both cases.

Understand with the help of illustration 1 of New and old tax regimes for taxpayers:-

Illustration | Old Tax Regime | New Tax Regime |

Income From Salary | 50,00,000 | 50,00,000 |

Less:- Exemptions | (1,60,000) | Not Allowed |

Gross Total Income | 48,02,000 | 50,00,000 |

Less:- Standard Deduction | (50,000) | (50,000) |

Less Deduction U/s Chapter VI-A | (1,50,000) | Not Allowed |

Less:- Deduction U/s 80D | (25,000) | Not Allowed |

Less:- Other Deduction If any | Allowed | Not Allowed |

Net Taxable Income | 45,77,000 | 49,50,000 |

Note: - Assume that the taxpayer is less than 60 years of age.

B. Total taxes payable under the new and old tax regimes

Tax Calculation Slab | Old Tax Regime Rates | Tax (Old) Amount | Tax Calculation Slab | New Tax Regime Rates | Tax (New) Amount |

0 – 2,50,000 | 0% | Nil | 0 – 3,00,000 | Nil | Nil |

2,50,000 - 5,00,000 | 5% | 12,500 | 3,00,000 - 6,00,000 | 5% | 15,000 |

5,00,000 -10,00,000 | 20% | 1,00,000 | 6,00,000 - 9,00,000 | 10% | 30,000 |

Above 10,00,000 | 30% | 10,73,100 | 9,00,000 - 12,00,000 | 15% | 45,000 |

12,00,000-15,00,000 | 20% | 60,000 | |||

Above 15,00,000 | 30% | 10,35,000 | |||

Total Tax | 11,85,600 | Total Tax | 11,85,000 | ||

Add: Higher Education Cess @4% | 47,424 | Add: Higher Education Cess @4% | 47,400 | ||

Total Tax payable | 12,33,024 | Total Tax payable | 12,32,400 |

As the example above shows, people take home more money under the new tax system, but the situation will be different if the amount of additional payments and deductions are higher. It is therefore advisable to calculate your tax due under both regimes.

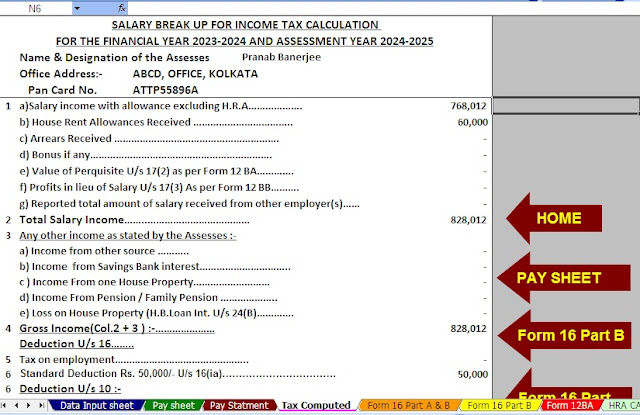

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Non-Government Employees Salary Structure.

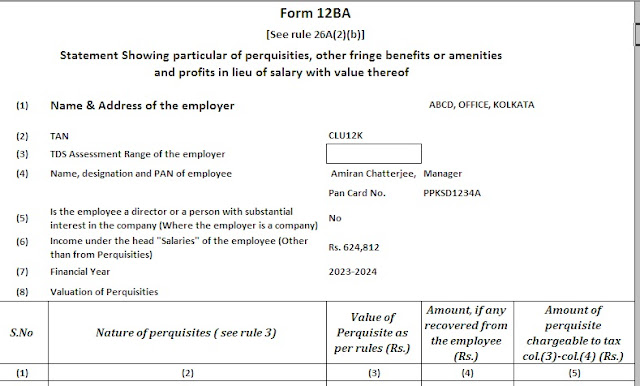

4) Automated Income Tax Form 12 BA

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24

7) Automated House Rent Exemption Calculation U/s 10(13A)

April 10, 2023

April 10, 2023

0 comments:

Post a Comment